The new year is right around the corner, and with it comes a significant change for cannabis consumers in Michigan. If you’ve been purchasing recreational marijuana, prepare yourself for a major hit to your wallet: the state tax is set to soar substantially starting January 1st!

This isn’t a small adjustment. Recreational cannabis is currently taxed at a combination of excise tax and state sales tax. Post-January 1st, recreational cannabis is set to be taxed at 34% state tax plus the 6% sales tax. That means for every dollar you spend on recreational products, you could soon be paying 40% in total taxes.

The Smart Solution: Go Medical and Lock In Your Savings

Here’s the good news: there is a reliable way to avoid this impending tax hike, and Pharmhouse Wellness is here to make it easier than ever.

Purchasing cannabis with a Michigan Medical Marijuana Card exempts you entirely from that steep recreational state tax.

Instead of navigating the massive 34% state tax increase, medical cardholders simply pay the 6% state sales tax.

Why This Tax Difference is Huge:

For a regular consumer, that difference in taxation puts hundreds of dollars back into your pocket every single year.

- If you spend just $150 a month on cannabis, avoiding the state recreational tax could save you an estimated $612 over the course of the year.

- Once obtained, the medical card ensures you benefit from these tax-free purchases for two years.

Beyond Savings: Medical Product Benefits

While the savings are compelling, a medical card also ensures access to products tailored for wellness and medicinal needs:

- Higher Potency Edibles: Medical cannabis edibles can contain up to 50mg of THC per serving, compared to the 10mg per serving limit for recreational products. This higher dosage is crucial for patients managing severe symptoms like pain or nausea.

- Wider Access: Being a medical patient may provide enhanced legal protection, especially if you travel in states where cannabis is only medically legal.

Still Seeking the Smart Solution? Get Your Med Card Today

While our “Free Med Card” promotion has reached its limit due to overwhelming demand, the financial math hasn’t changed: Going medical is still the single best way to protect your wallet from the new tax hike.

Even without the fee waiver, a medical card is a smart investment. The estimated cost for the doctor’s evaluation is $115, but with the total tax burden on recreational cannabis now reaching an estimated 40%, the card pays for itself in record time. For most regular consumers, you will recoup that $115 investment in just two or three modest purchases through the massive tax savings alone.

We’ve Kept the Process Simple & On-Site

We might not be picking up the tab anymore, but we are still dedicated to being your one-stop shop for medical access. We continue to offer:

- Instant On-Site Service: No need to hunt for a clinic. Use our private, dedicated telehealth station right here in the shop.

- Expert Guidance: Our team will walk you through the state registration process so you don’t have to navigate the paperwork alone.

- Fast Approval: Most patients complete their consultation and receive their digital certification in about 15 minutes, allowing you to shop medical-grade products and lower tax rates almost immediately.

Don’t Pay the “Road Tax” on Your Wellness

The new tax changes were designed to “fix the roads,” but they shouldn’t break your budget. By maintaining a medical card, you are choosing a path that prioritizes patient access and long-term financial wellness.

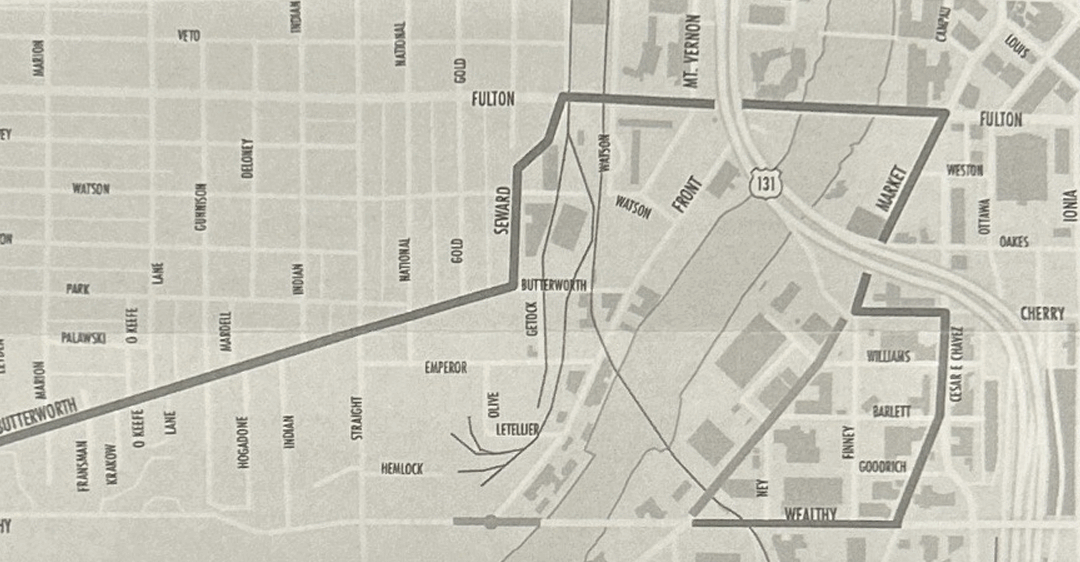

Stop by Pharmhouse Wellness at 831 Wealthy St SW, Grand Rapids. Our team is ready to help you get certified and ensure you never pay more than you have to for the medicine you need.ss.